It’s January. You’re busy closing out the books for last year and gearing up for the new one. Suddenly, you see a notice mentioning “1099 deadlines,” and a cold sweat breaks out.

Am I supposed to be doing that?

If you run a business and you paid people who aren’t on your official payroll, the answer is likely yes.

Don’t panic. Here is a guide to what you need to do right now for the 2025 tax year, and what’s changing for the 2026 tax year thanks to the One Big Beautiful Bill Act (sometimes called OBBBA or OB3).

What is a 1099 anyway?

Think of a W-2. That’s the form you give employees to tell the IRS how much you paid them in wages.

A 1099 is basically a W-2 for everyone else. It tells the IRS, “I paid this person or business some money, but they aren’t my employee, so I didn’t withhold any taxes for them.”

If you don’t file these forms, the IRS doesn’t know that person earned income. More importantly for you, if you get audited, the IRS might disallow the deduction for that expense and hit you with penalties for not filing the forms.

The Basic Rule

Generally speaking, a business must issue a 1099 if:

- You made the payment in the course of your trade or business (personal payments don’t count).

- You paid an individual or an unincorporated business (like a sole proprietor or most LLCs).

- The total amount paid during the year met a certain dollar threshold.

That “dollar threshold” is where things just got interesting.

In 2025, legislation was passed that changed the reporting thresholds. It is vital that you do not mix up the rules for the year that just ended versus the year that just started.

For the 2025 Tax Year (What you are filing RIGHT NOW)

The threshold is still $600.

If you paid a contractor, freelancer, or landlord $600 or more total between January 1, 2025, and December 31, 2025, you need to file a 1099 for them immediately.

For the 2026 Tax Year (Planning for NEXT January)

The threshold has increased to $2,000.

Starting with payments made on or after January 1, 2026, you only need to issue a 1099 if you pay that vendor $2,000 or more during the year. This is great news, as it reduces paperwork for many small businesses moving forward.

Which Form Do I Use?

There are many types of 1099s, but you likely only care about two.

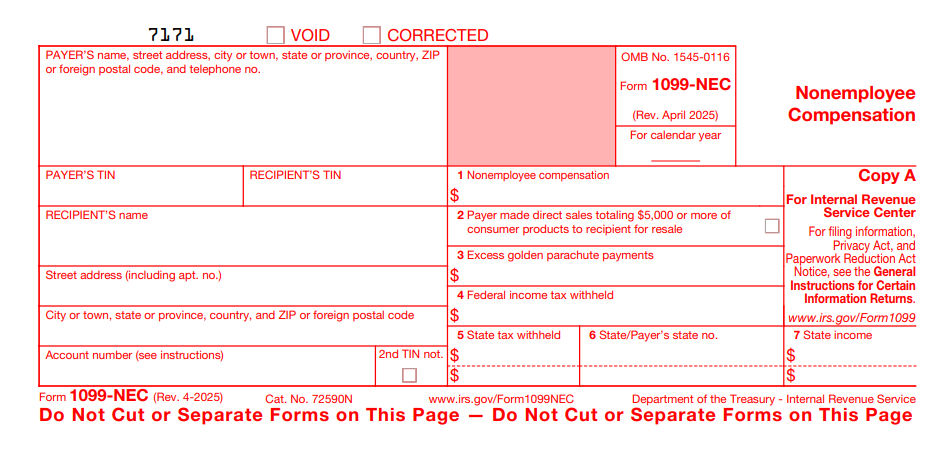

1. Form 1099-NEC (Non-Employee Compensation) This is the most common one. Use it if you paid someone for services.

- Examples: You hired a freelance graphic designer, a local handyman to fix the office sink, an independent IT consultant, or an attorney.

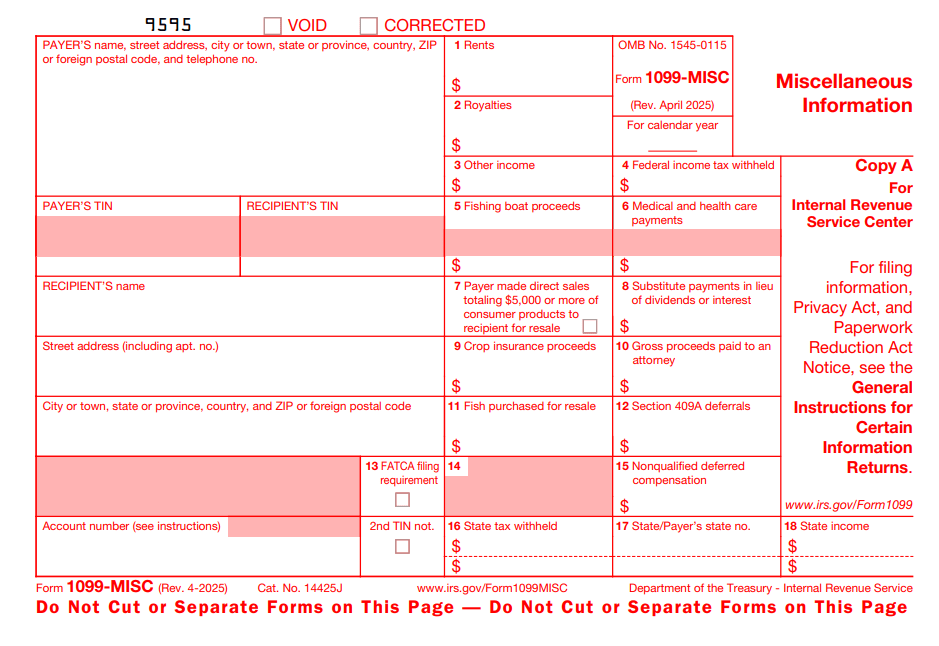

2. Form 1099-MISC (Miscellaneous Information) Use this for payments that aren’t for services. The most common use for small businesses is rent.

- Examples: You pay rent for your office space to a landlord (who isn’t a corporation).

Exceptions to Issuing 1099’s

Even if you paid someone over the threshold, you might not have to file. Here are the two biggest exceptions:

Exception 1: Corporations. You generally do not need to send a 1099 to a business that is incorporated (an S-Corp or a C-Corp).

- The tricky part: You usually can’t tell just by looking at their name. An “LLC” might be taxed as a corporation, or it might be a disregarded entity. This is why you must collect a Form W-9 from every vendor before you pay them. The W-9 tells you their tax status.

- Attorneys: You almost always have to send a 1099 to attorneys for legal fees, even if they are incorporated.

Exception 2: Credit Cards. If you paid a contractor using a credit card, debit card, or a third-party business network like PayPal or Venmo (using a business profile), you do not need to file a 1099-NEC. The payment processor handles their own reporting (Form 1099-K) for those transactions. You only file if you paid via check, cash, or direct bank transfer (ACH).

You have to File with the IRS, not Just the Vendor

You have to file the form 1099’s with the IRS and include a form 1096 summary with each type of form. If you file 10 or more 1099’s in aggregate, you must submit them electronically. Most accountants are set up to file 1099’s electronically on behalf of your business.

The Deadline is Here

If you need to file for the 2025 tax year (using that $600 rule), the deadline to get the forms to both the recipients and the IRS is February 2, 2026.

If you realize you have missed some contractors, act now. Collect their W-9s and get those forms filed. If you are overwhelmed by the new rules or the tight deadlines, give me a call immediately. We can help you sort through your vendor list and ensure you stay compliant.

Leave a comment